How 2,000+ Investors and Growing Are Getting Exclusive Access to Pre-IPO Startups

The Hidden Opportunity in Private Markets

Most accredited investors miss out on the highest-growth phase of startup investing because of limited access, outdated investment guidance, and complexity.

At Elysium, we solve this by offering a clear, structured path into exclusive, high quality venture opportunities —before they hit mass adoption.

Why Top Investors Choose Us

Vetted, High-Potential Startups – Back companies selected for strong traction, proven founders, and billion-dollar market potential.

Real Results, Proven Returns – Our structured approach has delivered ROI as high as 560% on select portfolio assets.

Built-In Risk Controls – We combine diversified exposure, deep due diligence, and active advisory to de-risk early-stage investing.

Insider-Level Access – Get in early—before institutional capital—through preferred terms and priority rights.

Hands-On Portfolio Management – We work directly with founders to scale operations and position for strategic exits.

Exclusive, Vetted Startups – Our expert team selects high-potential companies with strong early-stage fundamentals.

Proven Track Record – Historical ROI's have reached as high as 560% through our structured approach.

Risk-Managed Growth – We diversify investments, conduct due diligence, and provide strategic guidance and operational support to our portfolio companies.

Priority Access – Gain first rights to invest before these companies reach institutional investors.

Active Portfolio Management – We work hands-on with founders to optimize growth and maximize exits.

Our Investments Have Been Featured In:

An Asset Class That’s Created More Wealth Than Any Other

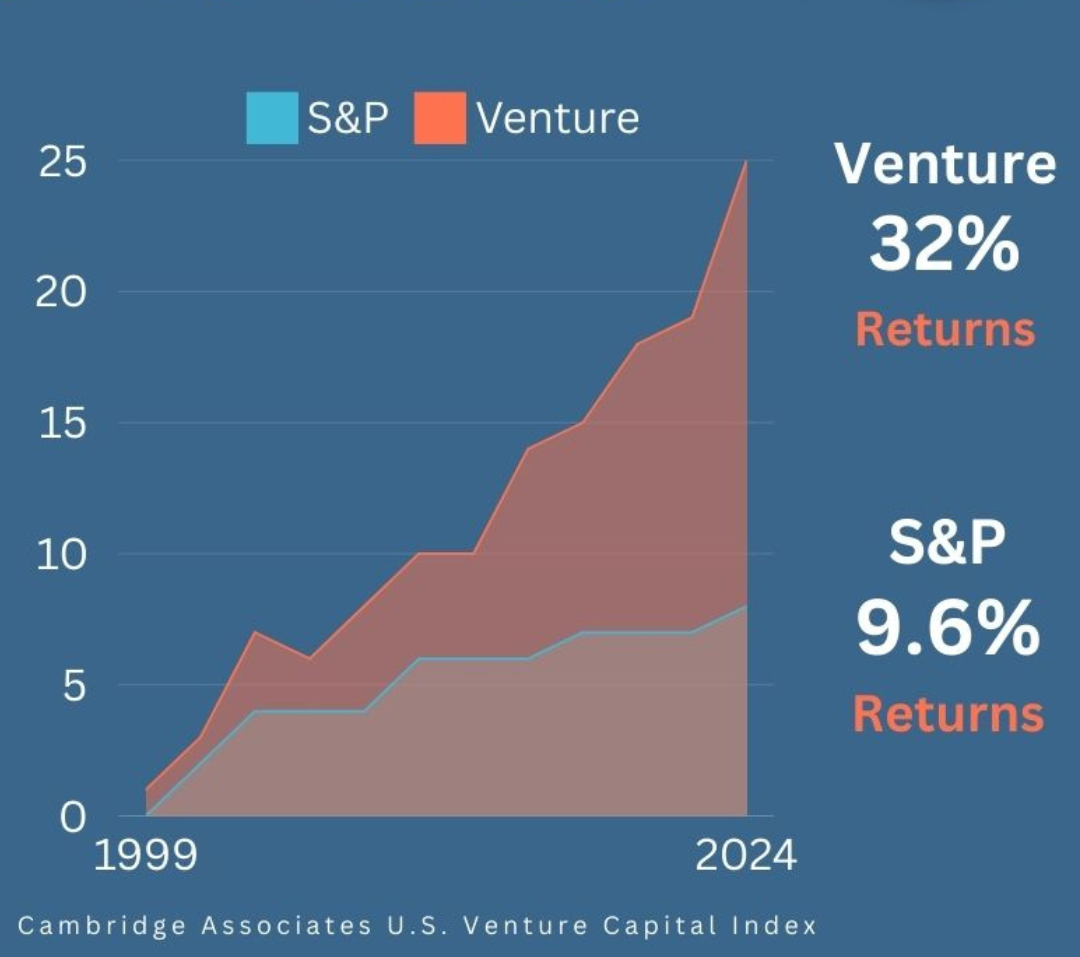

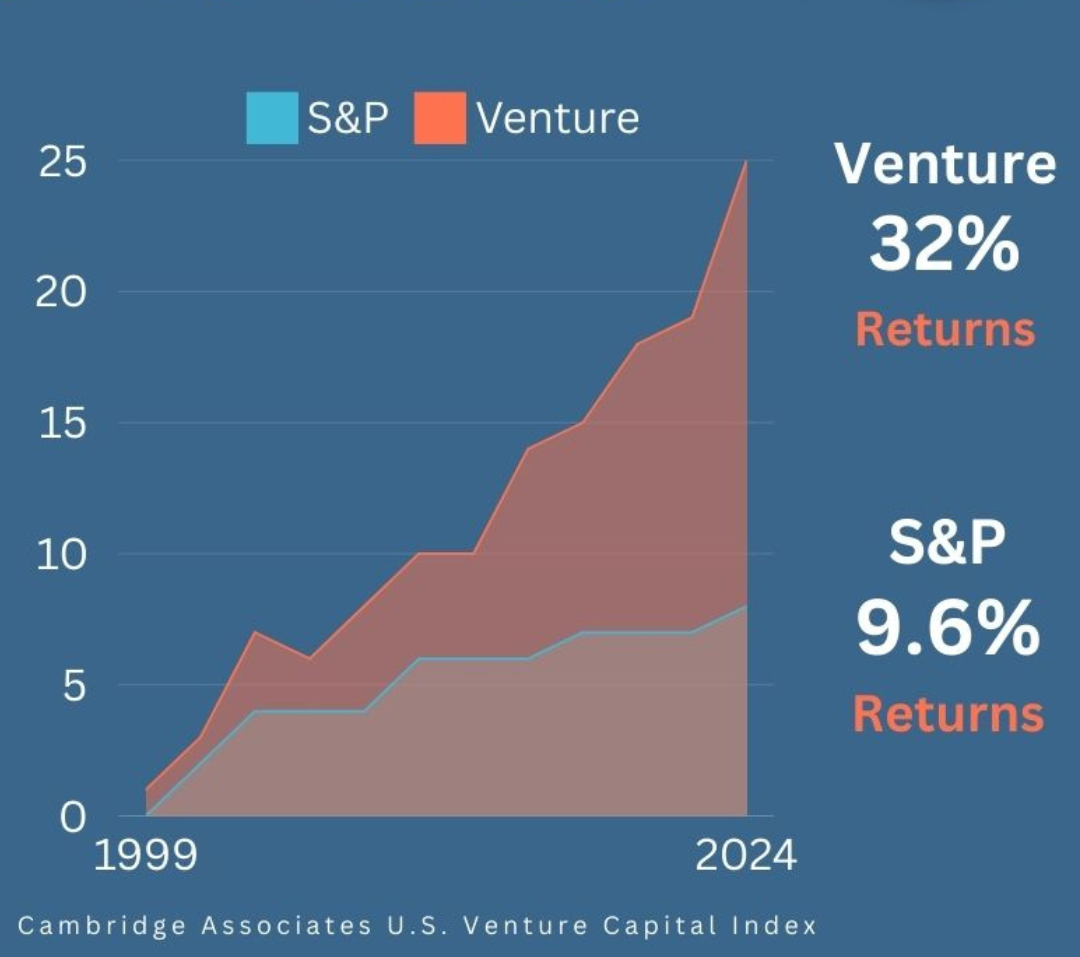

Only 3% of accredited investors are tapping into venture opportunities —an asset class that has outperformed the S&P 500 by 3x over the last 25 years.

Elysium’s Fund 1 gives you a chance to access these superior returns through our own curated portfolio.

How We Invest

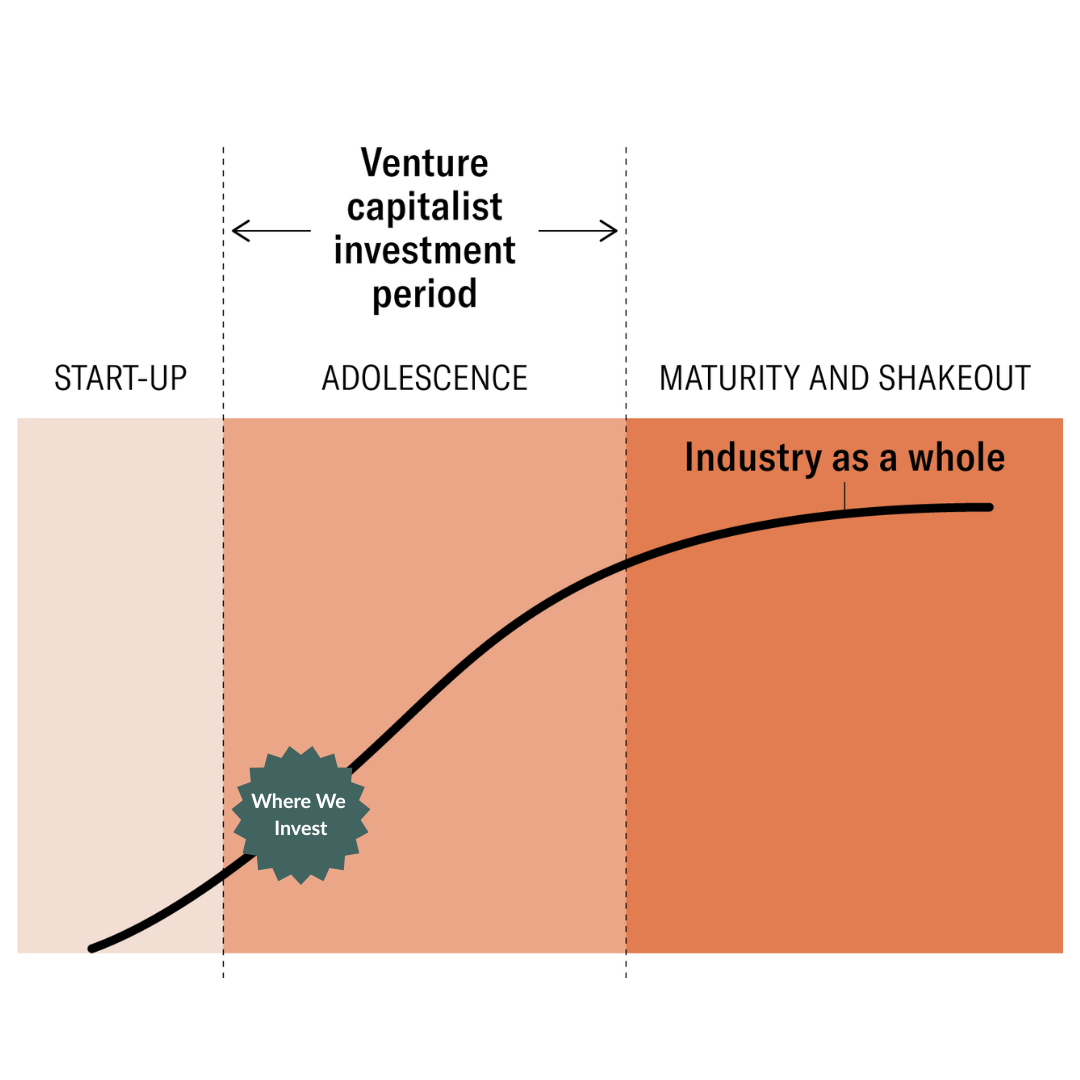

The S-Curve Advantage

Venture Investing targets the period between startup and maturity, known as the S Curve pattern

The vast majority of Investors enter a company only after it has reached maturity on the open markets, and their biggest valuation gains have passed. Elysium gives you the access point just prior the high-growth phase known as the S-Curve advantage.

How We Serve You

We Handle the Heavy Lifting – From sourcing and vetting, to structure and transaction. We are full underwriters acting on behalf of Limited Partners.

Exclusive Deals – We find, access and secure assets with the alpha growth potential, before institutional investors muddy the waters.

Risk-Managed Investments – Every portfolio asset is meticulously sourced, vetted, and structured. We reduce risk by embedding strategic oversight, active advisory, and proven performance frameworks from day one.

More Than Capital – We don’t just invest—we actively help our portfolio companies grow through strategic guidance, operational support, and hands-on involvement to drive stronger, more successful outcomes.

Passive Investing, High Upside – Your capital is actively managed across a curated portfolio, with each asset guided through key growth stages and positioned for strategic exits.

The Kind of Companies You’ll Be Proud to Back

See How Elysium’s Fund Is Securing Some Of Today’s Best Opportunities

Accredited investors are pouring capital into trillion-dollar markets—but few ever get in early

where the real upside lives. Elysium changes that.

Beverage Alcohol

Asset: Stealth | Status: GTM/Scale

The global alcoholic beverages market is valued at approximately USD 1.6 trillion as of 2023, and is projected to grow at a CAGR of around 3% to 4% through 2025. Source

Home & Beauty

Asset: Stealth | Stage: Pre-Rev

The global organic products market + residential energy market is estimated to be worth over USD 6 Trillion , with an average projected CAGr of 7%. (Source, Source 2*)

Fashion Apparel

Asset: Stealth | Stage: GTM

The global online apparel market is estimated at approximately USD 475 billion and is projected to grow at a CAGR of around 8% to 12% over the next five years. (Source*)

Real Estate (REIT)

Asset: Stealth | Stage: GTM

The global luxury real estate market, including second homes and high-end properties, is valued at about USD 316 billion and is projected to grow steadily, The sector is also bolstered by rising demand for concierge services and secondary market liquidity. (Source*)

Ed Tech

Asset: Stealth | Stage: GTM

The global online education and tutoring market is valued at about USD 230 billion and is anticipated to grow at a CAGR of approximately 12% over the next decade, fueled by technological advancements and the increasing acceptance of online learning platforms. (Source*)

Elysium Fund 1

Portfolio of early, risk-adjusted and high-growth potential companies addressing $9 Trillion in Total Market Value. Fund Horizon: <2.5-7 years. Target IRR: 20-50%. Fund Size: $25M-100M.

Why This Matters

Public investments = slower growth, lower ROI.

Elysium provides exclusive access to pre-IPO private equity deals, typically reserved for institutional investors.

Our hands-on approach helps startups scale, mitigating risk while maximizing upside potential.

What is Elysium & How Does It Work?

Discover how we provide accredited investors with exclusive access to high-growth private equity opportunities.

1. What is Elysium, and how does it work?

Elysium is a private equity fund that gives accredited investors exclusive access to early-stage, high-growth startups in industries like Beverage Alcohol, Fashion, Real Estate, Fintech, EdTech, and more. We provide a structured, hands-on approach to investing, while applying advisory andkey risk-mitigation frameworks that we believe enhance paths to success.

2. How does Elysium select startups for investment?

We follow a rigorous selection process, vetting each company based on:

✅ Market potential & growth trajectory

✅ Strong founding team & proven business model

✅ Scalability & competitive edge

✅ Financial health & investment readiness

Our team does the heavy lifting, so you invest with confidence.

3. What makes Elysium different from other private equity or venture capital funds?

Unlike traditional funds, we:

🚀 Invest before IPOs – Giving you access to high-upside startups before the masses.

🔍 Provide hands-on support – We work closely with founders to maximize growth.

📈 Offer diversification – We invest across multiple industries to mitigate risk.

💡 Ensure investor-first transparency – No hidden fees, just a direct path to high-growth investments.

4. What kind of returns can I expect?

Elysium targets 8–50x equity multiples, but as with any investment, returns are not guaranteed. Our approach focuses on long-term growth, strategic exits, and high-upside potential to maximize your portfolio’s success.

📊 Example of past results:

✅ One portfolio company generated $800K in revenue in 9 months

✅ Investors have seen 560% return on ad spend (ROAS)

5. What is the minimum investment required?

To maintain exclusivity and high-growth potential, we require a minimum investment of $50,000.

This ensures we work with serious investors who are ready to access institutional-level private equity opportunities.

6. How does Elysium reduce risk?

Private equity investing always carries risk, but we mitigate it through:

🔹 Expert Due Diligence – We thoroughly vet every startup.

🔹 Portfolio Diversification – Investing across industries reduces exposure to market downturns.

🔹 Hands-On Growth Support – We help startups scale strategically.

🔹 Early-Stage Access – Investing at lower valuations increases upside potential.

By aligning investor success with startup growth, we build a risk-managed, high-reward portfolio.

7. How long is my investment locked up for?

Elysium’s fund follows a 3–5 year capital lock-up period, allowing companies to grow and reach ideal exit opportunities such as:

✅ IPOs

✅ Acquisitions

✅ Secondary market sales

This timeline maximizes returns while giving investors a clear long-term strategy for wealth creation.

8. How do I track my investment performance?

We provide:

📊 Regular performance updates on portfolio companies

📞 One-on-one investor calls to discuss progress

📑 Exclusive investor reports detailing growth milestones

You’ll always have full transparency into your investments.

9. Who qualifies to invest with Elysium?

We work exclusively with accredited investors who meet SEC guidelines, meaning you must meet one of the following criteria:

✅ $1M+ in net worth (excluding primary residence)

✅ $200K+ annual income ($300K for joint filers)

Not sure if you qualify? Schedule a call to find out!

10. Can I invest through an IRA or other tax-advantaged accounts?

Yes! Many of our investors use:

✅ Self-Directed IRAs (SDIRAs)

✅ Solo 401(k)s

✅ Trusts & family offices

Our team can guide you through structuring your investment for maximum tax efficiency.

11. How do I get started?

It’s simple:

1️⃣ Schedule a call to confirm your eligibility.

2️⃣ Review our investment opportunities.

3️⃣ Secure your position in high-growth startups.

Home & Beauty

Asset: Stealth | Stage: Pre-Rev

The global organic products market + residential energy market is estimated to be worth over USD 6 Trillion , with an average projected CAGr of 7%. (Source, Source 2*)

Fashion Apparel

Asset: Goldie Byrd | Stage: GTM

The global online apparel market is estimated at approximately USD 475 billion and is projected to grow at a CAGR of around 8% to 12% over the next five years. (Source*)

Real Estate (REIT)

Asset: Stealth | Stage: GTM

The global luxury real estate market, including second homes and high-end properties, is valued at about USD 316 billion and is projected to grow steadily, The sector is also bolstered by rising demand for concierge services and secondary market liquidity. (Source*)

Ed Tech

Asset: Stealth | Stage: GTM

The global online education and tutoring market is valued at about USD 230 billion and is anticipated to grow at a CAGR of approximately 12% over the next decade, fueled by technological advancements and the increasing acceptance of online learning platforms. (Source*)

Elysium Fund 1

Portfolio of early, risk-adjusted and high-growth potential companies addressing $9 Trillion in Total Market Value. Fund Horizon: <2.5-7 years. Target IRR: 20-50%. Fund Size: $25M-100M.